2022

Activity

The activities of STIFA focus on the supervision of common-benefit foundations and establishments as well as private-benefit foundations and establishments that have voluntarily submitted to supervision. Unless the entity is exempted from the obligation to appoint an auditor, STIFA receives an annual audit report on the proper management and use of the assets for its supervisory purposes. These reports are processed by STIFA and, if necessary, regulatory measures are requested from the Princely Court of Justice. In the case of foundations and establishments that are exempt from the obligation to appoint an auditor, STIFA normally carries out audits itself every three years. Furthermore, STIFA’s remit also includes checking the accuracy of the filed notifications of formation and amendments in the event of private-benefit foundations not entered in the Commercial Register.

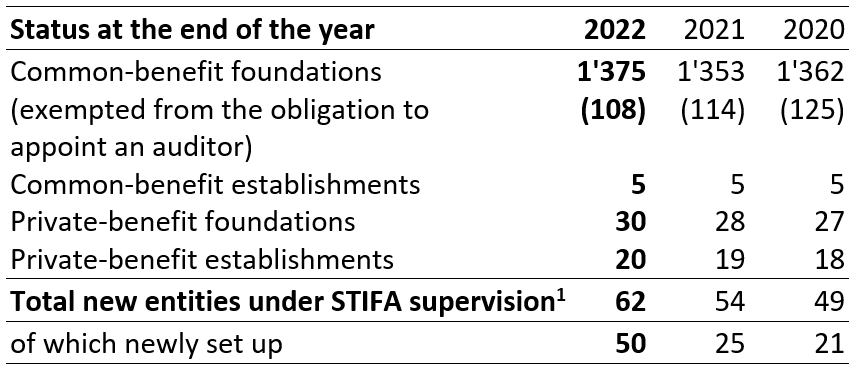

Supervised entities

1 These numbers include common-benefit and private-benefit foundations and establishments.

Besides the 62 foundations and establishments that came under supervision for the first time in the year under report, 39 supervised foundations were put into liquidation, one establishment was released from the supervision of STIFA and 36 foundations were removed from the Commercial Register. The number of common-benefit foundations thus experiences a positive increase in the reporting year for the first time since 2019 (increase by 1.6% compared to the previous year). The number of common-benefit foundations that came under supervision of STIFA for the first time is higher than the number of terminations. It can be noted that the number of terminations in the year under review has decreased by one third compared to the previous year, while the number of common-benefit foundations newly placed under supervision of STIFA has increased.

Proceedings concerning auditors

During the year under review, 103 foundations and establishments applied to the Princely Court of Justice for statutory auditors to be appointed. This also includes those proceedings in which an application was made for the replacement or dismissal of auditors. STIFA was a party to each of these proceedings. During the year under review, six common-benefit foundations applied to STIFA to be exempted from the obligation to appoint an auditor (Art. 552 § 27 Para. 5 PGR).

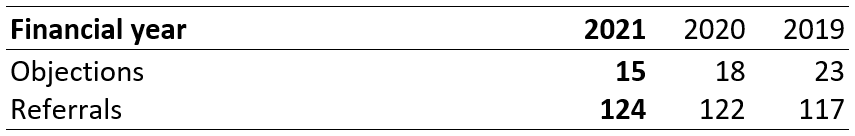

Audits conducted by the auditors

On 31 December 2022, 100 (previous year 106) audit reports relating to the financial year 2021 were still outstanding. This means the above stated number of objections and referrals relating to the audited 2021 financial year is expected to increase until the reports have been submitted in full.

With regard to the objections raised by auditors relating to the 2021 financial year, it should be noted that these were largely due to improper use of the assets, in particular due to the lack of distributions over a longer period of time. Furthermore, deficiencies in the management of the assets (e.g. disproportionately high costs for the foundation administration) as well as organisational shortcomings (e.g. lack of approval by foundation bodies to resolutions) also led to objections.

With regard to the referrals made by auditors concerning the 2021 financial year, the picture is broadly similar, namely that a large proportion of the matters requiring notification related to deficiencies in distribution practice. A large number of referrals were also made for the purpose of informing STIFA about pending legal proceedings or about an accounting over-indebtness pursuant to Art. 182e and Art. 182f PGR.

STIFA has examined the objections and referrals identified by the auditors and has taken the necessary measures.

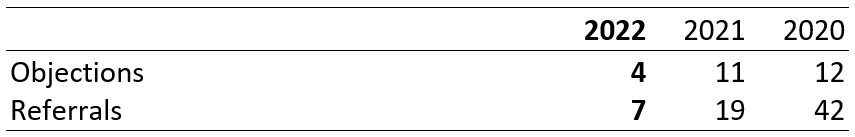

Audits conducted by STIFA

In the case of foundations and establishments that are exempt from the obligation to appoint an auditor (by the end of 2022: 108), STIFA normally carries out the audit itself every three years. STIFA subjected a total of 33 (34 in the previous year) common-benefit foundations to an independent audit during the year under review, whereby these audits were carried out by correspondence, analogous to the previous year, due to the Covid-19 pandemic. Furthermore, in the year under review, STIFA carried out a final independent audit (also by correspondence) of five foundations that were exempt from the obligation to appoint an auditor as a result of a decision to dissolve the foundation, so that these foundations could subsequently be terminated.

On 31 December 2022, 32 audits of STIFA were still pending (among other things because of limited resources of STIFA due to the Moneyval-Assessment of Liechtenstein). This means the above stated number of objections and referrals will increase until the audits of STIFA have been completed in full.

With regard to the objections and referrals ascertained by STIFA, it should be noted that the picture is broadly analogous to the objections and referrals made by the auditors. The findings were mainly made due to the improper use of the assets of the foundation, in particular due to the lack of distributions over a longer period of time, as well as organisational shortcomings (i.e. insufficient resolutions of the Board of Foundation). In addition, STIFA pointed out disproportionately high costs for the foundation administration in relation to the approved distributions. Furthermore, STIFA revoked the exemption from the obligation to appoint an auditor for five foundations, among other things for the reason that a reliable assessment by STIFA of the ultimate use of the assets was not possible.

STIFA took the necessary measures based on the objections and referrals identified.

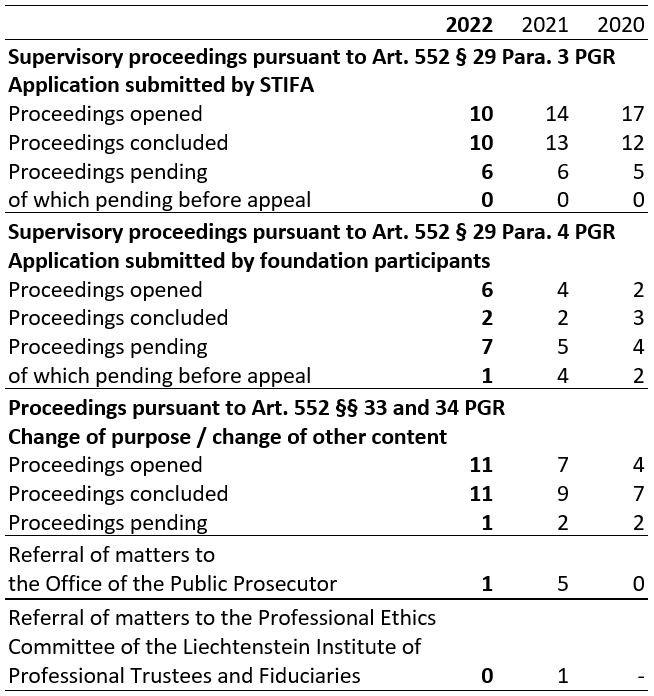

Supervisory proceedings and other proceedings

In ten cases STIFA applied to the Princely Court of Justice for supervisory measures during the year under review (Art. 552 § 29 Para. 3 PGR). In addition, in six instances foundation participants applied to the Princely Court of Justice for supervisory measures to be taken against foundations and establishments subject to STIFA supervision (Art. 552 § 29 Para. 4 PGR). STIFA was a party to each of these cases.

Furthermore, in the year under review STIFA was asked to make statements in eleven cases on account of its party status in respect of changes to the purpose and other contents of the foundation documents, in particular the organisation, that had been requested at the Princely Court of Justice (Art. 552 § 33 and 34 PGR).

In addition, in the year under review, STIFA reported one case to the Office of the Public Prosecutor on suspicion of criminal offences. There were no cases reported to the Professional Ethics Committee of the Liechtenstein Institute of Professional Trustees and Fiduciaries on suspicion of possible violations of the Code of Professional Conduct.

Audits of formation and amendment notifications

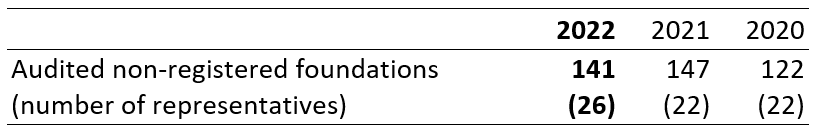

In the case of a total of 26 representatives, the accuracy of the notifications of formation and amendments of private-benefit foundations not entered in the Commercial Register (Art. 552 § 21 PGR) was verified on a random basis during the year under review.

With regard to the total of 141 foundations audited, STIFA was informed of the following objections and referrals by the appointed auditors:

- In the case of four foundations, STIFA was notified of referrals due to organisational deficiencies. However, the deficiencies were of a purely formal nature and were not covered by the information required to be notified according to Art. 552 § 20 PGR, so that no further measures on the part of STIFA were taken.

- In the case of two foundations, it was found that these foundations have a common-benefit purpose, but were not registered in the Commercial Register and were not subjected to STIFA supervision. In the case of one foundation, the Board of Foundation has already taken the necessary steps to restore the lawful state of affairs; in the second case, STIFA has asked the foundation concerned for its statement and will, if necessary, initiate further measures based on the response.

- In the case of one foundation, SITFA was informed by the appointed auditor that the will of the founder could not be established materially. Since the founder had already died before the foundation was established, the deficiency could not be remedied. STIFA will ask the foundation concerned for its statement and will, if necessary, initiate further measures.

- In the case of three foundations, it was found that there were discrepancies between the foundation documents and the information deposited with the Commercial Register regarding the registered office and the purpose. In one case, the correct registered office has already been (subsequently) provided to the Commercial Register as a result of the audit. In the other cases, STIFA has requested the foundations concerned for their statements and will, if necessary, initiate further measures based on their responses.